When I want something in another room, I send my son to get it. It’s what kids are for. The best way to get work done is to get someone else to do it for you.

That’s the principle behind investing. When you invest, your money does the heavy lifting. With $25 and a willingness to automatically transfer money into your first investment account each month, you can enjoy the benefits of letting your money work.

It’s not something that will lead to huge returns immediately, but over time you might be surprised to see how your money grows.

Get off your assets.

No one likes freeloaders. If someone is sleeping at your place, you at least want them to do the dishes. When your money sits in a savings account, it’s sleeping on the couch without helping out with anything.

You’ll never build the wealth you need for financial freedom if you don’t move your assets. Once you have built up a comfortable emergency fund, stop relying entirely on that savings account and open an investment account. It’s easy enough, even if you only have $25 to start.

Your first investment account should be with a broker that allows you to invest a small amount of money to begin with. There are accounts that allow you to start with as little as $5 a week. If you have a little more, you can start investing with a service like Betterment with $100 a month.

All you need is the same information you use to open a bank account, and your bank account information. Set up an automatic investment plan so that money is automatically moved from your bank account to your investment account. You can also use a service like Acorns to automatically invest your pocket change.

Have an open relationship with your money.

Don’t be loyal to one bank account or even to your first investment account. It’s ok to work your assets in any way that helps you build wealth.

Start with your company’s tax-advantaged retirement account. If your company offers a 401(k) and you contribute, you’re investing. Use that to your advantage, and take the biggest match possible. Many people don’t think of company retirement plans as investing, but it is. It’s the easiest way to open your first investment account, and you can reap benefits for years to come.

You don’t need to be a one-account investor, though. If you have the right information, you can open an account with an online discount broker (like TradeKing or E*Trade), robo advisor (like Betterment), or a “traditional” company like Vanguard or Fidelity. There are a number of ways for you to open different investment accounts to fulfill different purposes. If you don’t like what’s offered by your company’s plan, get the maximum match, then open an account with a different broker.

Get your money out there to make an effort. I was pleasantly surprised the other day to discover that my regular effort with my money has been paying off. I’ve been contributing to a travel fund, and my money has been busy. It’s worked for me, and with the help of compound interest, is already offering a great return.

How to open your first investment account.

When you’re ready to spread a little more canvas with your money, keep the following in mind:

Get personal.

You need identifying information to open an investment account. Your name, address, birth date, Social Security number, and bank account information will be needed. The law requires brokers to collect this information from you.

Have your personal information ready. Even if you open an account using the internet, having it nearby keeps you from being timed out of the session before you’re ready.

If you do open your investment account using the internet, make sure you are on a private connection. Do it from a password-protected network, not public Wi-Fi. This is sensitive stuff and you don’t want it out there.

Index funds are better to start.

They aren’t sexy, but index funds, which follow set groups of stocks, such as the Dow Jones Industrial Average, or the S&P 500, can be an easy way to get the most out of your investing dollar. You don’t have to pick stocks (which can get tricky), and you enjoy instant diversity.

Some discount brokers, like Acorns and Betterment, won’t let you pick your own funds. However, they usually have access to low-cost ETFs that are broad enough to provide you with the diversity and performance that keeps pace with the market in general. And that’s exactly what you need when you start out.

Do it in your sleep.

Put your assets to work while you sleep. Schedule automatic transfers from your account to the investment account. Most brokers offer an “automatic investment plan.” Sign up for it. It’s better when things happen while you’re not thinking about them.

Start small.

Even if you’re broke af, you can still afford to invest. With some discount brokers, it’s possible to automatically invest $5 a month. You eventually need to step it up and show your investment account some love, but starting small gives you the chance to let your money begin. The longer your money is at it, the greater the chance you’ll see bigger results down the road.

You still need to boost your contributions over time, though. As soon as you can, increase the amount you invest. You don’t want to sit on your assets when you have them. They should be out working hard for you.

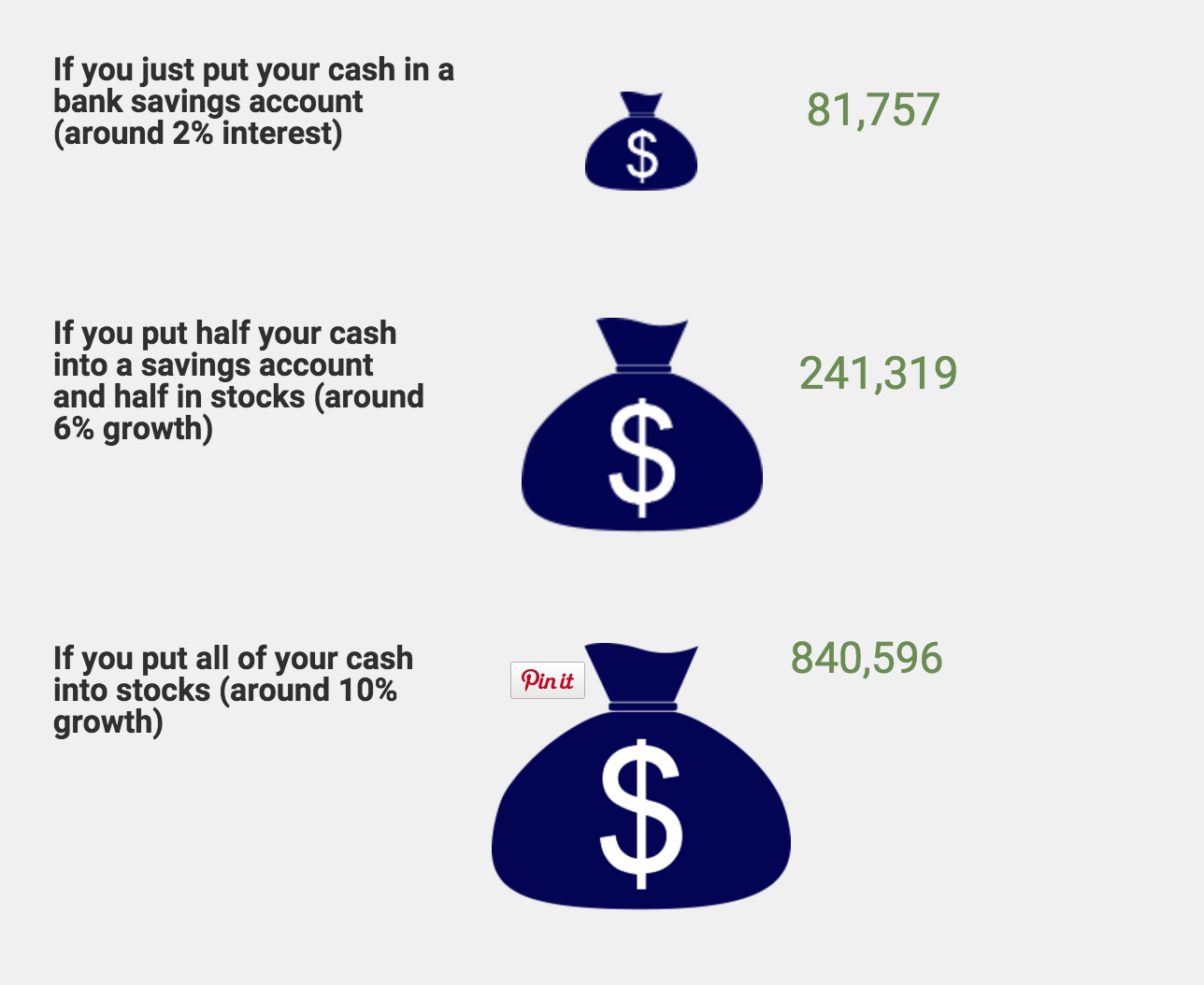

The following, from Calculate My Wealth, shows you how you should be working your assets. Start investing $100 per month at age 22, and do it until you’re 65, and here’s what you could have:

Unlike investments, that savings account is definitely a freeloader.

Make investing a priority.

There are a lot of things you could be doing with your money. Investing should be a priority. Yes, you need to pay down debt (especially if it comes with a high interest rate). And you have bills. You’d probably like to enjoy an evening out on occasion. But if you have even a little, tiny bit you can put toward investing, make it a priority.

In many ways, it’s about the habit. Start the habit of investing if you want to make a difference in your financial life. Once you get started and see the good results of your efforts, you’ll want to do even more investing.

Get started, and then look for ways to boost your contributions. No, $5 a week isn’t going to make all your retirement dreams come true. But if you start with that $5 a week, and then you make room to boost it to $10 a week after a couple months, pretty soon you’ll find that you have more money than you thought to invest.

Skip one night out a month. And invest the money you would have spent. Start a side hustle. Invest any money you make. Your account will build much faster that way.

Whether you make it a point to have money taken from your paycheck each month for your retirement account, or whether you invest your pocket change (or do a little of both!), the important thing is to get started and make investing a priority going forward.